When it comes to trading penny stocks, timing and information are everything. These small-cap stocks often move quickly, and capturing the right moment can make the difference between a profitable trade and a missed opportunity. That’s why savvy traders rely heavily on penny stock alerts — instant notifications that can guide them to promising opportunities before the crowd catches on.

In this article, we’ll explore two timely penny stock alert tactics that can help you seize quick profits. Whether you’re a seasoned trader or just getting started, these strategies will sharpen your approach and boost your chances of success.

Why Penny Stock Alerts Matter

Penny stocks trade at low prices — typically under $5 per share — and are often subject to high volatility. This means their prices can spike or drop drastically within minutes or hours, creating fast profit potential for traders who can act quickly.

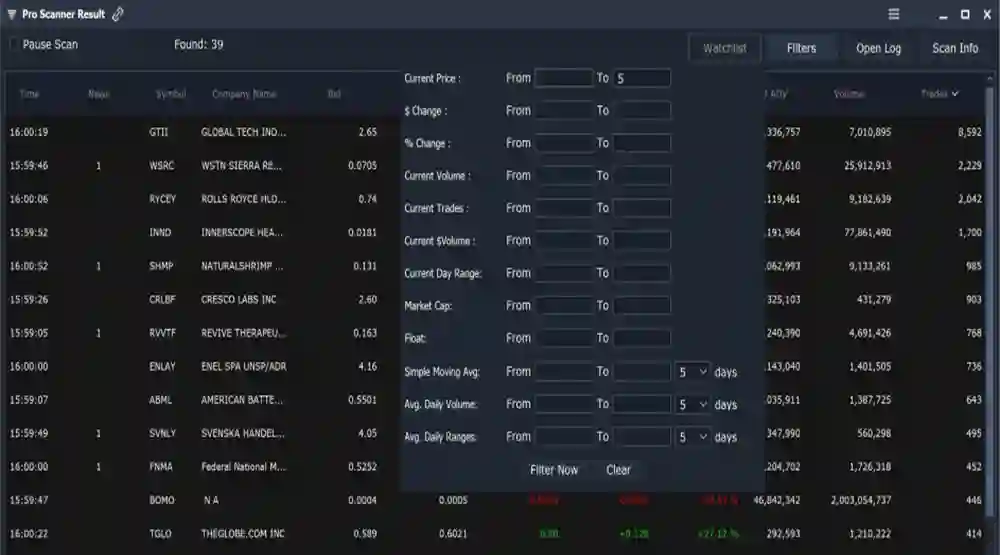

This is where penny stock alerts come in. These alerts are signals generated by specialized software, analysts, or alert services that identify stocks with promising setups. They can tell you when a stock is showing momentum, breaking out, or hitting key support levels.

But not all alerts are created equal. The best traders use fast penny stock alerts for big gains — meaning they get notified immediately when a stock is showing signs of a rapid move. This speed allows them to enter or exit trades at the optimal moment.

Tactic 1: Momentum Confirmation with Volume Spikes

One of the most reliable signals for quick penny stock profits is the confirmation of momentum through volume spikes.

How it works:

- When a penny stock suddenly experiences a surge in trading volume, it means there is a fresh influx of buyers (or sellers) interested in that stock.

- Volume spikes often precede or coincide with significant price moves.

- Traders who receive penny stock alerts tied to these volume surges can act quickly before the stock’s momentum fades.

What to look for:

- A volume increase of at least 2-3 times the stock’s average daily volume.

- A corresponding price breakout above resistance levels or key moving averages.

- Confirmation from technical indicators like RSI or MACD showing bullish momentum.

Why it works:

Volume is the fuel that powers price moves. Without increased volume, price changes lack conviction and can quickly reverse. By combining volume spikes with price action, you’re more likely to catch genuine momentum plays rather than false breakouts.

Example:

Imagine a penny stock trading at $1.20 suddenly surges to $1.50 on triple its normal volume, triggering your fast penny stock alerts for big gains. You can quickly enter the trade and ride the momentum upward, taking profits before other traders pile in and cause a sharp pullback.

Tactic 2: News Catalyst Alerts for Quick Reaction

News moves markets — especially small-cap penny stocks where rumors, earnings, or corporate announcements can trigger swift price changes.

How it works:

- Certain penny stocks react explosively to company news, such as new contracts, FDA approvals, or major partnerships.

- Being among the first to know about these developments gives traders a significant edge.

- Advanced penny stock alerts systems scan news feeds and social media channels to deliver fast penny stock alerts for big gains right when the catalyst breaks.

What to look for:

- Unusual news volume or mentions on social platforms.

- Press releases that detail potentially market-moving information.

- Regulatory filings or insider activity reports that could signal upcoming price moves.

Why it works:

By reacting swiftly to news catalysts, traders can enter trades before the broader market has digested the information. This early entry position often allows them to capture the initial burst of gains as other investors rush to buy.

Example:

Suppose a penny stock suddenly announces a breakthrough product or signs a big deal, causing an immediate spike in interest. Your alert service sends you a notification within minutes, and you quickly place your buy order, catching the stock before it skyrockets 50% or more in a single day.

Maximizing Profits with Timely Penny Stock Alerts

While these tactics are powerful on their own, the key to maximizing profits is combining them with the right alert system. Not every alert service offers the speed, accuracy, or actionable insights needed for quick gains in penny stocks.

Look for alert providers that:

- Offer real-time notifications with minimal delay.

- Provide clear entry and exit signals based on proven technical setups.

- Have a track record of delivering fast penny stock alerts for big gains to traders.

By using these types of services, you reduce the risk of missing out on critical moves and increase your ability to capitalize on short-term price action.

Final Thoughts

Penny stocks offer exciting profit potential, but success depends heavily on timing and information. By focusing on volume spike momentum and news catalyst alerts, you can significantly improve your chances of quick profits. And by leveraging the power of penny stock alerts — especially fast penny stock alerts for big gains — you position yourself to act decisively when opportunities arise.

As always, remember that penny stock trading involves risk, and it’s essential to use sound money management practices. But with the right tactics and timely alerts, you can tilt the odds in your favor and make the most of the exciting penny stock market.

If you want to stay ahead in this fast-paced market, consider subscribing to a reliable penny stock alert service today and start receiving the kind of fast penny stock alerts for big gains that can transform your trading game.